Price your event too low and you’ll leave money on the table; price it too high and you’ll watch seats sit empty. Finding that “just right” middle is both art and science—and it’s where smart ticket pricing strategies can transform your results. With the right mix of tiers, timing, and data-driven tweaks, you can grow attendance, increase average order value, and still have fans feeling great about what they paid.

Why care this much about pricing? Because it’s one of the strongest profit levers you control. As classic pricing research shows, even a small, well-planned price move can materially change profitability—especially if you protect perceived value and trust. At the same time, demand for live experiences remains high, but many attendees are more cost-conscious than they were a year or two ago. The takeaway: be intentional, be transparent, and match your price to the value you deliver.

“Pricing is one of the most powerful—and underused—levers for profit. Small, well-tested price moves can deliver outsized gains when value is clear and volume holds.”

Source: McKinsey & Company on the power of pricing.

In this guide, you’ll learn how to read your audience, package value, and apply specific approaches—early-bird, good–better–best tiers, dynamic updates, bundles, and more—without undermining fairness. We’ll also show you how to use analytics and customer feedback to validate decisions and evolve across the registration cycle.

The Loopyah Content Team shares expert insights, practical guides, and industry updates to help event organizers create unforgettable experiences and stay ahead in the event planning world.

Before you touch a price tag, clarify two things: who you’re serving and what the experience is worth to them. Pricing isn’t just math—it’s messaging, segmentation, and confidence in your offer.

Segment your audience by both demographics and behavior. For instance, first-time festival-goers, loyal superfans, local families, and corporate buyers often have different willingness to pay, purchase timing, and appetite for perks.

Map commitment windows: Many events see a surge 31–60 days out and again in the final 2–3 weeks. Align deadlines to those peaks.

Gather clues from past editions: What tiers sold fastest? Which channels drove higher average order values? Who bought add-ons?

Listen to sentiment: Use post-event surveys, social comments, and support emails to identify perceived value drivers (and friction).

Practical tip: Ask three micro-survey questions right after purchase: “What made you buy today?”, “What nearly stopped you?”, and “Which benefit mattered most?” Then adjust fences and messages around those signals.

Price is a promise. If you’re charging more, attendees must feel the difference before, during, and after the event. Inventory your experience assets and turn them into visible benefits at clear price points.

Access: Premium seating, early entry, VIP lounges, or exclusive meet-and-greets.

Comfort and convenience: Fast-lane entry, concierge support, dedicated bars or restrooms, reserved parking.

Content and capability: Bonus workshops, recordings, speaker Q&A, backstage tours.

Memorabilia and mementos: Limited-edition merch bundles, commemorative lanyards, or signed posters.

For organizers working to keep margins healthy without surprising attendees, tighten your cost structure and value story together. If you’re building your budget now, our guide can help: How to Build an Event Budget.

Mix and match the plays below to match your audience, inventory, and calendar. Most successful events don’t rely on one technique; they orchestrate several, with clear communication and guardrails.

Early-bird works when it aligns with when your audience actually commits. Industry data shows a large share of registrations arriving in the final month, with a revenue “sweet spot” in the 31–60 day window. That’s why many planners have introduced an “Advance” tier between early-bird and standard to capture intent closer to showtime.

Best practices:

Open registration without deep discounts. Use a modest early-bird as a nudge—not a bargain—to protect perceived value.

Add an “Advance” tier roughly 2–3 weeks out for a final conversion push. Deadline-driven messaging performs best here.

Position high-value add-ons when intent peaks (e.g., 2–5 weeks out). Late registrants tend to spend more on extras.

For a deeper dive on shifting commitment windows and how to place your deadlines, see this analysis from PCMA: Rethinking Early-Bird Pricing.

Want to turn those deadlines into demand? Pair pricing moves with smart promotion. Start here: How to Sell More Tickets for an Event.

A simple and powerful framework: package your offer into clear tiers with escalating benefits. “Good–Better–Best” nudges value-seekers up the ladder while giving budget-conscious buyers a solid entry point. The key is to define price fences so each tier feels distinct and worth the step up.

General Admission (Good): Non-refundable, standard seat/entry, access to core program.

Plus (Better): Refundable until X date, preferred seating zone, drink ticket, early entry, bonus session.

VIP (Best): Premium seat selection, lounge access, merch bundle, artist/speaker meet-and-greet, concierge support.

If you sell reserved seating, an interactive map makes your fences obvious (and upsells more intuitive). Learn about using seat maps to showcase value: Interactive Seat Charts.

Dynamic pricing adjusts price based on demand, time remaining, inventory mix, and other signals. It’s powerful for perishable inventory (like seats), but it must be handled with care. Many consumers feel taken advantage of when prices swing without explanation, so pair dynamic moves with visible guardrails and consistent value messaging.

Post a price range by tier (e.g., “GA will range from $59–$79”). It sets expectations and reduces surprise.

Define maximum daily/weekly move sizes (e.g., no more than $5 per day) to avoid whiplash.

Use messaging that ties price to value/availability: “Only 25 seats left in this section at this price.”

Group offers can unlock attendance from teams, families, or alumni—but use them surgically. Broad discounts can anchor perceptions that full price is unfair. Instead, fence group pricing to specific segments and qualifying quantities.

Corporate bundles: 5-, 10-, or 20-ticket packs with invoice support and a coordinator contact.

Student/educator groups: Valid ID, weekday sessions, or balcony sections to protect premium inventory.

Community partners: Limited codes for nonprofits with capped redemptions and clear expiration dates.

Bundles increase perceived value by packaging what attendees already want—access + perks—at a single compelling price. Framing these offers around outcomes (“Skip the lines and enjoy two exclusive tastings”) outperforms simple dollar-off messages.

Workshop + GA bundle: Save time and secure your seat in the most popular breakout.

Merch + VIP: Limited-edition hoodie, VIP lanyard, lounge access, and a photo op.

Family pack: 2 adults + 2 youth with early entry and reserved picnic area.

Bundles also reduce price comparison friction, making it easier to choose a higher-value option because the final, all-in price is clear upfront.

Behavioral pricing tactics don’t replace value—they amplify it. Use them ethically to make decisions easier and signal quality when you truly deliver more.

Leverage left-digit effects for your broadest tiers. Many buyers perceive $49.99 as materially lower than $50, even though the nominal difference is a cent. Use “just-below” endings for GA and mid-tier packages.

Examples: $39, $59, $79—anchor price steps while preserving up-sell space.

Use round numbers sparingly on mass tiers; keep them for premium signals.

Higher prices shape expectations. For VIP or ultra-limited experiences, round numbers (e.g., $250 or $500) can signal confidence and exclusivity. But the experience must match the promise—comfort, access, and service need to feel unmistakably premium.

Deliver the premium difference early: priority communications, special check-in, and a “wow” moment within the first 10 minutes on site.

Limit supply and show scarcity honestly (e.g., “Only 50 VIP passes released”).

Pricing is a living system. Track it, test it, and tune it throughout your sales cycle. A lightweight analytics setup pays for itself the first time it catches a miscalibrated tier—or green-lights a profitable adjustment.

At minimum, measure conversion by tier, deadline, section, and channel. Tag your marketing campaigns so you can attribute higher AOV to specific messages or bundles—and quickly spot when a price fence isn’t pulling its weight.

Set up ecommerce tracking for key events (view_item, add_to_cart, begin_checkout, purchase) and include parameters for tier, package, and deadline.

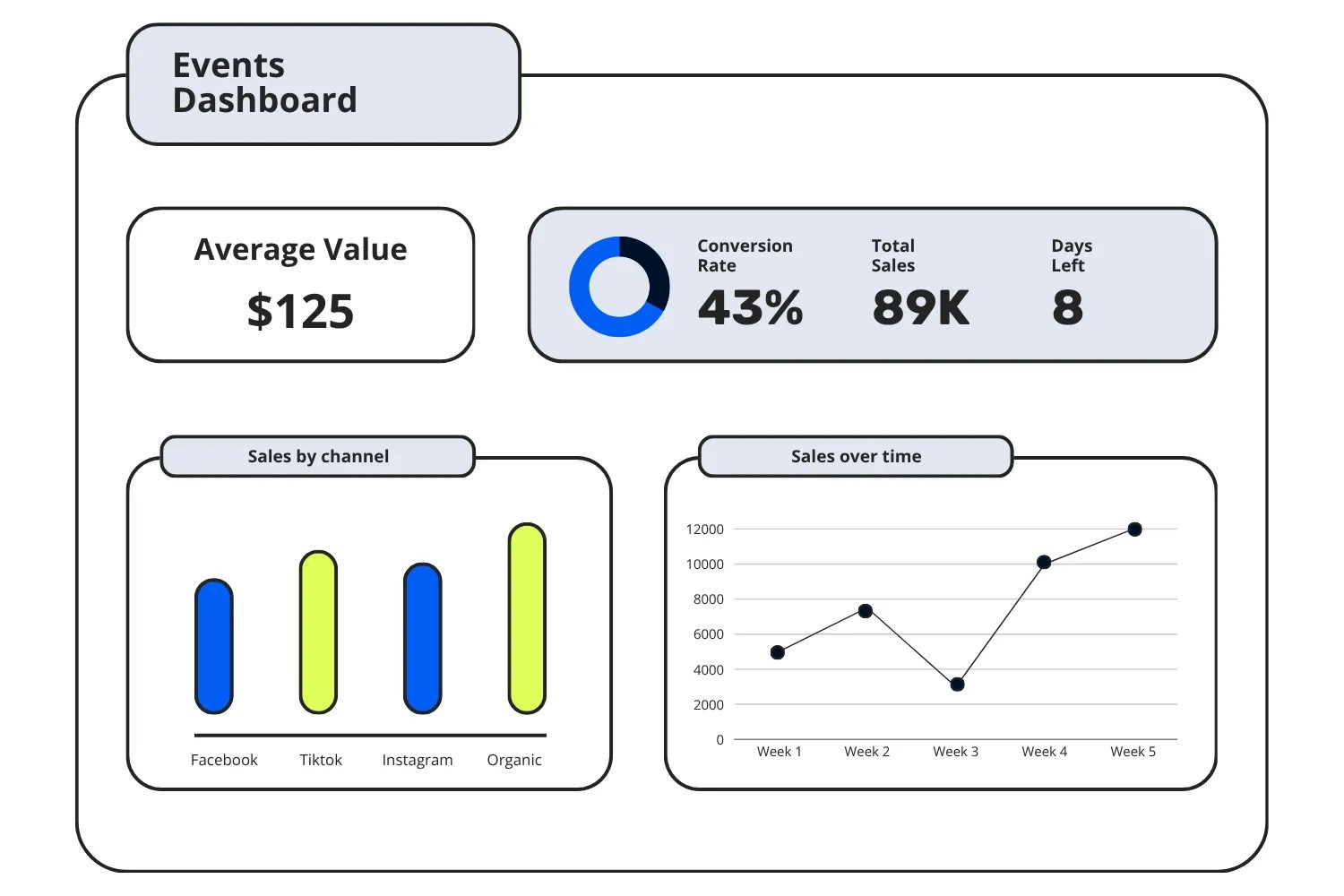

Create a weekly “pricing performance” dashboard: revenue per tier, sell-through by section, AOV, attach rates for add-ons, and refund/cancel trends.

Define test rules upfront: minimum sample sizes, maximum price moves, and a stop-loss if conversion dips beyond X% for Y days.

Schedule two to three “pricing reviews” during the cycle (launch, 30–45 days out, final 10 days) to decide on adjustments.

If you need an all-in overview of tools that support a pricing and promotion workflow, take a look at our event software features to see how everything fits together from ticketing to communications.

Pair your hard numbers with voice-of-customer signals before and after price changes. Consumers will pay more for better experiences—yet trust erodes fast when pricing feels opaque. Build quick feedback loops to keep your strategy honest.

Post-purchase micro-survey: “How fair did today’s price feel?” (1–5), “What influenced you most?” (deadline, seat, perks, bundle).

Social listening: Track mentions of “pricey,” “worth it,” and “deal” to understand sentiment drivers.

Onsite intercepts: Ask a sample of VIP and GA attendees which benefits mattered most and what would have made them upgrade.

Complement pricing with buzz-building. Creative promos and partnerships can increase perceived value and justify your tiers. Try these ideas next: Creative Event Promotion Ideas.

The organizers of a mid-sized summer festival wanted to protect margins while keeping GA accessible. They set visible price ranges for each tier (e.g., GA from $69–$89) and established small, predictable move sizes. Prices updated weekly based on sell-through by section and time remaining. “Budget GA” remained fixed at $59 with fewer benefits to preserve a fair entry point.

What changed:

Faster early commitments in premium sections once ranges were published—buyers understood that waiting would likely cost more.

Higher add-on attach rates (drink packages, parking) during the 2–4 weeks pre-event, when intent peaked.

Better price-realization on VIP as inventory became scarce—but without backlash, thanks to published ranges and consistency.

Takeaway: Dynamic pricing can optimize perishable inventory and average order value when it’s transparent, predictable, and paired with a steady-price entry option.

A B2B conference serving product leaders faced late registrations and forecasting headaches. The team introduced Early, Advance, and Standard tiers and aligned deadlines with observed intent spikes: Early ended about five weeks out; Advance spanned the two weeks before the event; Standard covered the final stretch.

What changed:

Volume smoothed across the cycle, easing venue and catering forecasting.

Higher AOV from an “All-Access” bundle added to the Advance tier (recordings + workshop credit).

Clearer value story at each tier reduced discount requests and protected list prices.

Takeaway: Three well-spaced tiers match real buying behavior and create natural moments to nudge upgrades without heavy discounts.

Chasing volume with discounts rarely makes up for the margin you lose. Pricing research shows how even small across-the-board cuts can erode profits disproportionately. Instead of defaulting to lower prices, tighten your value story and use targeted fences (non-refundable GA, limited student sections, or weekday-only offers).

Measure elasticity first: Run a controlled test on a small block of seats or a single channel before rolling out a cut.

Protect reference prices: Avoid frequent couponing that trains your core audience to wait for deals.

Deep dive on why small price moves matter: The Power of Pricing (McKinsey).

Some fans will pay a premium for better experiences—but price fatigue is real. If you raise list prices without visible improvements, you risk deterring casual attendees and dampening word of mouth. Stress-test willingness to pay with bundles, pilots, and small cohort experiments before ratcheting list prices.

Make premium benefits obvious in your sales page hero area (photos, diagrams, and bullet-point fences).

Bundle before you bump: Add perks that cost less than the perceived value to justify a higher ticket.

Competitor ranges are a useful reference—but they shouldn’t run your strategy. If your event offers unique access, better production, or a stronger community, price to that differentiated value. Use competitor tracking to avoid extreme outliers and to frame your communication (“Here’s what you get that others don’t”).

Build a simple tracker: Event name, dates, tiers, fences, and sold-out signals. Update weekly during your launch window.

Avoid price wars: Compete on packaging, service, and community perks instead of matching every discount.

Smart ticket pricing strategies aren’t about squeezing buyers—they’re about matching price to value, meeting your audience where they are, and communicating clearly. Start by understanding your attendees and your experience, then layer early-bird timing, good–better–best tiers, transparent dynamic pricing, targeted group offers, and bundles. Use behavioral cues like charm or prestige endings ethically, and let data and voice-of-customer steer your adjustments across the cycle.

Need more demand to power those tiers? Pair your pricing plan with strong promotion and partnerships. If you’re experimenting with free/low-cost tickets to grow your base for future upsells, you’ll also like: Use Free Ticketed Events to Grow.

When you’re ready to implement, choose a platform that supports tiering, deadlines, and clear communications so you can launch with confidence and iterate quickly.