When budgets tighten, the events that stay funded have one thing in common: they’re built on a strategic event management process. Rather than a one‑off “show day,” strategic event management treats every event as a business endeavor designed to drive measurable outcomes—pipeline, revenue, retention, and brand equity—that compound over time. Even when marketing budgets tighten up, events remain a priority when they are clearly tied to growth and measured with rigor.

Gartner reports that marketing budgets have dropped to 7.7% of company revenue in 2024—yet leaders still invest in experiences that move the needle when they see a clear business case. Source (Gartner CMO Survey).

In this guide, we’ll show you how to plan with executive confidence, execute with cross‑functional precision, and instrument data so the ROI is unmistakable.

But first, let's have a look at what strategic event management is.

Strategic event management is the end‑to‑end practice of designing, delivering, and measuring events that directly advance your organization’s strategy. It aligns every decision—format, audience, content, pricing, promotion, and post‑event activation—to defined business objectives.

Where traditional planning focuses on tasks and timelines, strategic event management connects the dots from situation analysis and goal setting to tactics, governance, risk, and ROI attribution. Think of it as SOSTAC (ituation, bjectives, trategy, actics, ction, and ontrol) for events rolled into one living playbook your team can execute and adapt together over time.

The Loopyah Content Team shares expert insights, practical guides, and industry updates to help event organizers create unforgettable experiences and stay ahead in the event planning world.

Strategic alignment: Events ladder to enterprise objectives, quarterly OKRs, and go‑to‑market priorities.

Measurable impact: Clear KPIs, source‑of‑truth dashboards, and consistent attribution beyond vanity metrics.

Stakeholder buy‑in: A shared plan with decision rights, cadences, and communication that unlock cross‑functional execution (sales, product, CX, finance, legal, partners).

Risk readiness: Documented risk register, contingency playbooks, and rapid escalation paths to protect people, brand, and P&L.

Compounding value: Content, community, and data that fuel demand generation, ABM, partnerships, and product roadmaps after the event wraps.

Behind every high-performing event program are a few non-negotiable pillars that keep strategy, execution, and measurement tightly aligned. These pillars transform event planning from a series of tasks into a long-term growth engine that advances organizational goals.

Every decision — from venue selection to content themes — must ladder up to overarching business objectives. Strategic alignment ensures that events directly contribute to pipeline, revenue, customer retention, or brand equity. It also builds credibility with executives who need to see a clear business case for continued investment.

Strategy without data is guesswork. Modern event management relies on analytics at every stage — market research, persona insights, registration velocity, engagement metrics, and post-event ROI. Teams that integrate their event tech stack with CRM and marketing automation systems create a closed feedback loop that proves value and guides iteration.

Strategic events are never built in isolation. Marketing, sales, customer success, finance, and operations must move in sync under a shared governance model. Clear roles, decision rights, and communication cadences prevent last-minute churn and ensure seamless delivery from concept to execution.

No event strategy is complete without proactive risk planning. From budget volatility and vendor issues to safety and compliance, teams need a living risk register and contingency playbooks. Equally important is resource allocation — ensuring talent, technology, and budget align with the strategic priorities that drive the highest ROI.

The most successful event leaders treat every event as a learning cycle. Post-event data, attendee feedback, and sales outcomes fuel insights that refine the next iteration. Over time, this creates a repeatable system that compounds in efficiency and impact.

While the two terms sound similar, the distinction between event management and strategic event management is what separates a one-time production from a repeatable growth engine.

Traditional event management centers on logistics — booking venues, managing vendors, coordinating timelines, and ensuring the event runs smoothly.

Strategic event management, on the other hand, starts with business outcomes. Every element of planning and execution is tied to measurable objectives such as pipeline creation, customer retention, brand lift, or partner enablement.

In short: Event management delivers an event; strategic event management delivers results.

Event managers often rely on checklists and project timelines to stay organized. Strategic event managers take a data-driven approach — conducting situation analyses, defining SMART goals, tracking KPIs, and reporting ROI to stakeholders. They make informed decisions using analytics rather than intuition.

Event management tends to treat each event as a standalone project. Strategic event management views the entire event portfolio as part of the organization’s long-term marketing and growth strategy. Insights, content, and audience data flow between events to drive compounding value over time.

An event manager might work primarily with vendors and internal marketing teams. A strategic event manager operates cross-functionally, aligning marketing, sales, finance, operations, and customer success around shared KPIs and governance structures. This ensures that the event serves the broader go-to-market strategy, not just the marketing calendar.

Traditional event metrics focus on attendance, satisfaction scores, or social engagement. Strategic event management measures business impact — sourced and influenced pipeline, deal velocity, retention, and sponsor ROI — with data integrated across CRM, marketing automation, and analytics systems.

Start by writing 3–5 SMART goals—specific, measurable, achievable, relevant, and time‑bound—that map directly to your growth agenda. Use performance goals for familiar, near‑term outcomes (e.g., registrations, pipeline influence, sponsorship revenue), and learning goals where the team is experimenting (e.g., a new audience segment or hybrid format). The combination helps you deliver results now while building capability for later.

Brand and reach: Achieve 1.8M impressions and 25% growth in branded search in the 8 weeks surrounding the event; secure 10 media mentions and 3 analyst briefings within 30 days post‑event.

Demand generation: Generate 350 MQLs and 120 SQLs from target accounts; influence $2.5M in pipeline and $500k in closed‑won within 90 days.

Customer outcomes: Lift adoption of Feature X by 15% among attending customers; achieve NPS 60+ and 75% session satisfaction.

Sponsorship: Sell 90% of packages at tiered pricing; deliver average sponsor lead quality score of 8/10 and 30% renewal intent by survey.

Learning goal (innovation): Test a new VIP matchmaking lounge; target 40 curated meetings with 60% “high value” rating and document what worked/what didn’t.

Mini‑case: A B2B SaaS company’s user conference set a goal to influence $3M in pipeline from 200 target accounts. They aligned sales outreach, ABM ads, and executive roundtables to those accounts; pre‑booked 120 customer meetings; and measured pipeline within 90 days. Result: $3.4M in sourced and influenced pipeline, a 113% goal attainment—and a crystal‑clear case for expanding next year’s program.

A sharp strategy starts with a sharp diagnosis. Complete a one‑page situation analysis that clarifies your strengths and weaknesses, market dynamics, and the audience you must win. Pair SWOT with a light PESTEL review (political, economic, social, tech, environmental, legal) to surface risks and tailwinds. Then prioritize the 3–5 insights that matter most and convert each into a hypothesis your event will test.

SWOT highlights: Example—Strength: category‑leading product; Weakness: limited presence in the mid‑market; Opportunity: economic buyers hungry for ROI proof; Threat: two rival tours overlapping your dates.

Audience and personas: Codify 2–3 primary personas with jobs‑to‑be‑done, pain points, motivations, and channel preferences. Decide who the event is for—and who it is not for—so your program and media spend stay focused.

Competitor and trend scan: Map competitor events (themes, formats, pricing, sponsors, speakers). Track macro trends—rising AV and F&B costs, sustainability expectations, and attendees’ appetite for high‑quality, human‑first content over volume.

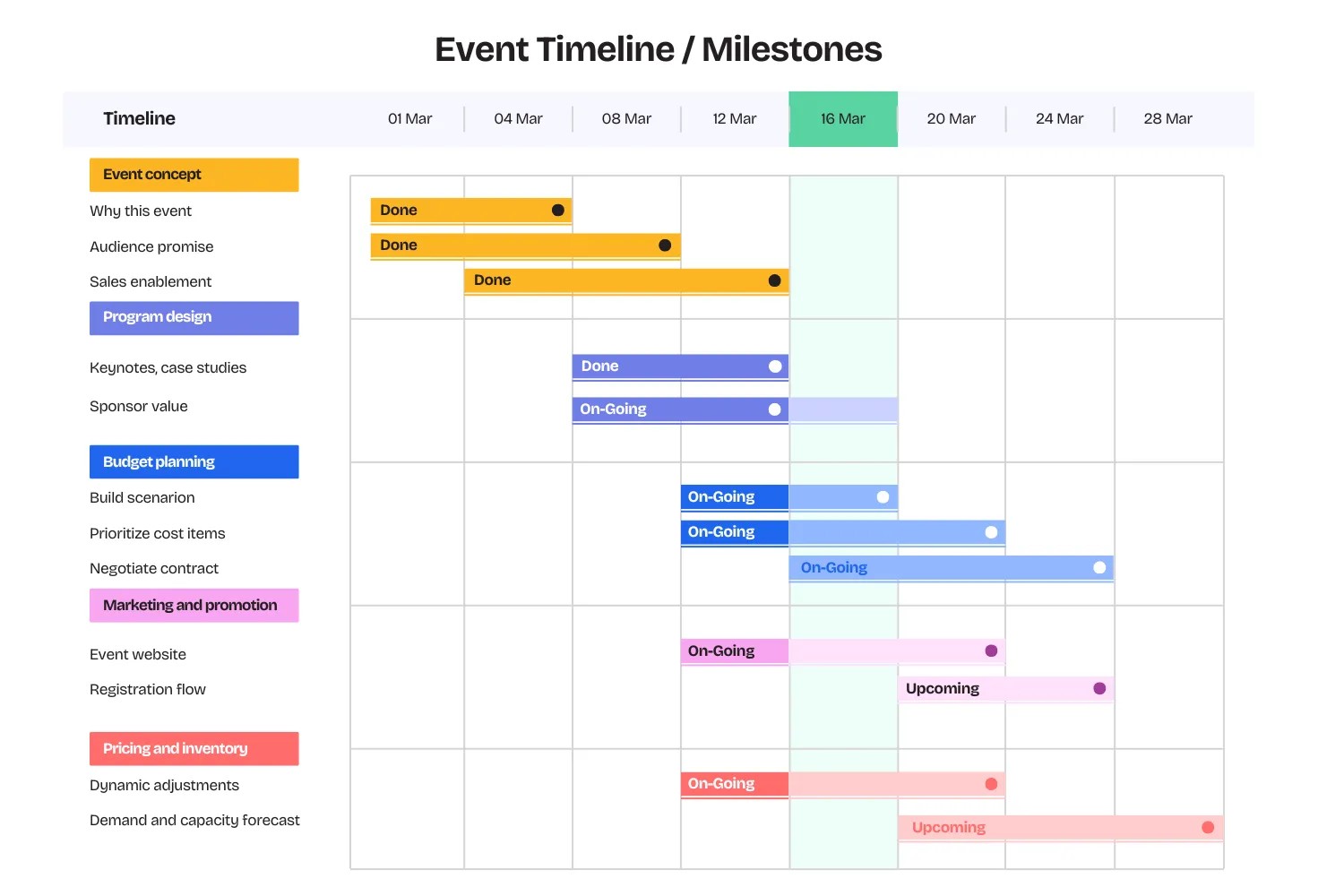

Event concept and audience promise: A simple, sticky proposition that answers “Why this event, why now, and why you?” Write a 3‑sentence brief to align creative, programming, and sales enablement.

Program design: Architect keynotes, case studies, hands‑on labs, and curated networking. Protect whitespace for serendipity. Add sponsor value through thought leadership and lead capture that attendees actually welcome.

Budget and scenario planning: Build base/optimistic/constrained budgets. Prioritize must‑haves vs. nice‑to‑haves and link each line item to an expected impact hypothesis. Rising AV and F&B costs? Pre‑negotiate and build buffers where risk is highest. Expand sponsorship inventory tied to measurable deliverables.

Timeline and stage gates: Work back from event day with weekly milestones. Insert stage gates for go/no‑go decisions on venue, production scope, headliners, sponsorship tiers, and paid media escalation based on leading indicators (e.g., registration velocity by segment).

Marketing and promotion: Nail the event website and registration flow, then orchestrate owned, earned, and paid channels. Pair persuasive creative with an airtight user journey from teaser to post‑event follow‑up.

Pricing and inventory: Combine early‑bird tiers with dynamic adjustments based on demand and capacity. If you have reserved seating, align price bands to sightlines and experience zones.

Risk management: Maintain a risk register, threat assessment (venue, crowd, travel), and contingency playbooks (weather, tech, medical, security, talent). Align with venue protocols and local authorities, and run table‑top exercises two weeks out.

Measurement plan: Define source‑of‑truth systems, tracking (UTMs, QR codes, GA4 events), and your executive scorecard before you launch. Decide which KPIs are leading vs. lagging and who owns weekly reporting.

Want to align your success metrics with the C‑suite? Bookmark our primer on event KPIs to choose metrics that matter from planning through post‑event reporting.

Stand‑ups and decision rights: Run a weekly cross‑functional stand‑up (marketing, sales, product, finance, ops, partners) with a clear agenda: decisions needed, risks, dependencies, and owner check‑ins. Use a RACI to avoid bottlenecks and last‑minute churn.

Vendor and venue orchestration: Lock scopes of work with SLAs and contact trees. Share your production schedule, rigging plots, and crew lists early. Conduct a pre‑con with the venue and run a timed simulation for critical moments (doors, badge printing surge, keynote transition, load‑out).

Staffing and training: Publish staffing matrices and shift rosters 2–3 weeks out. Train volunteers and brand ambassadors on customer service, accessibility, safety, and escalation. Equip them with mobile run‑of‑show docs and a comms channel for rapid issue resolution.

Tech‑enabled experience: Use digital check‑in, QR badges, and self‑service kiosks to slash queues. Deploy a mobile app for schedules, maps, and push alerts. Offer reserved seat maps for premium experiences and cashless or QR‑code F&B to reduce friction. Capture behavioral data everywhere: session scans, dwell time, polls, Q&A, and lead retrieval.

Run‑of‑show checklist (abridged): doors open, welcome desk staffing surge plan, badge reprint workflow, accessibility services, keynote walk‑in track, backstage comms checks, speaker green room, media check‑in, sponsor booth audits, housekeeping slides, emergency announcement scripts, and load‑out sequencing with vendor sign‑offs.

Measurement starts before promotion, not after opening night. Prebuild a scorecard that blends attendance and engagement with business outcomes. Define where each metric lives (registration platform, mobile app, POS, CRM, GA4), how it’s attributed, and when it’s reported to executives. Keep your categories consistent across the portfolio so you can benchmark event to event.

Reach and registration: Sources of traffic, conversion by channel, registration velocity by week/segment, discount code effectiveness, no‑show rate, and waitlist conversion. For digital behaviors, configure GA4 key events and conversions that mirror your funnel (e.g., landing_view, reg_start, reg_complete).

On‑site engagement: Check‑ins by hour, session scans, dwell time, app adoption, Q&A/poll participation, sponsor booth scans, and premium upgrade take‑rate (e.g., VIP lounge, reserved seating).

Satisfaction and quality: NPS, CSAT by session, and open‑ended themes. Keep surveys concise to avoid drop‑off and optimize for mobile. Use progressive profiling so each touchpoint adds signal without fatigue.

Need inspiration? Explore our post‑event survey questions to design feedback that drives action.

Commercial impact: Sourced and influenced pipeline, conversion by stage, deal velocity changes, sponsorship ROI, and customer expansion or retention lift. Report early indicators (e.g., meeting notes, intent signals) while waiting for lagging revenue data to mature.

Activate a 14–30 day “data‑to‑action” loop: 1) Sales follow‑up SLAs with prioritized lead lists; 2) Post‑event nurture with tailored content by persona; 3) Community prompts to keep momentum; 4) Content atomization into clips, blogs, and sales assets; and 5) Executive readout that closes the loop on goals, lessons, and next bets.

In modern event strategy, intuition alone isn’t enough. Every choice—from venue selection to content programming—should be guided by data. Data-driven decision making turns your event plan from a set of educated guesses into a measurable, continuously improving system that delivers business outcomes with precision.

A strategic event program starts with clean, connected data. That means unifying your registration platform, mobile app, CRM, and marketing automation so that every engagement—clicks, check-ins, session scans, and post-event conversions—flows into a single source of truth. When all stakeholders can see accurate performance metrics in one dashboard, decisions become faster and more aligned.

Data should inform not just what happened, but what to do next. Pre-event insights (audience behavior, registration velocity, content trends) help optimize promotion and pricing. On-site analytics (session attendance, dwell time, sentiment) reveal what resonates most with your audience. Post-event data (pipeline influence, deal velocity, sponsor ROI) validates success and guides the next cycle.

Example: If data shows that attendees who joined peer-to-peer roundtables had 2x higher pipeline influence, prioritize those formats in future programs.

Data only drives results when it’s tied to the right KPIs. Move beyond vanity metrics like impressions or badge scans. Instead, focus on measurable business impact:

Revenue metrics: sourced/influenced pipeline, average deal size, retention lift

Engagement metrics: dwell time, repeat attendance, content downloads

Experience metrics: NPS, session satisfaction, feedback themes

Rule of thumb: Every data point should answer one of three questions — Did it grow revenue? Did it improve customer relationships? Did it strengthen brand equity?

The next evolution of strategic event management is predictive analytics. By analyzing past performance, registration patterns, and engagement trends, teams can forecast demand, optimize pricing tiers, and allocate resources proactively. Real-time dashboards empower on-site teams to make agile decisions — like opening overflow seating, adjusting session timing, or pushing personalized content alerts.

Data is most powerful when it feeds directly into action. Post-event, share executive summaries and dashboards that tie outcomes to goals, document lessons learned, and identify next-cycle experiments. This continuous learning loop turns every event into a smarter, more efficient version of the last.

Your tech stack should unify registration, content, app‑based engagement, and analytics in one platform—then integrate cleanly with your CRM and marketing automation so the data actually does work for sales and success teams. A consolidated stack reduces handoffs and unlocks the portfolio view executives expect.

Registration and ticketing: tiered pricing, discount codes, group bundles, check‑out optimization, and compliant payments.

Event website builder and landing pages: fast setup, A/B testing, SEO basics, and embedded media to convert interest into registrations.

Seat maps and allocations: interactive seating, zones, holds, ADA and companion seats, and price bands for yield management.

Mobile app and on‑site ops: schedules, maps, push notifications, QR badges, kiosks, badge printing, and lead retrieval for sponsors and exhibitors.

Engagement features: live polling, Q&A, gamification (scavenger hunts, points), and networking to increase dwell time and satisfaction.

Analytics and ROI dashboards: registration velocity, channel mix performance, session‑level engagement, lead quality scores, and post‑event pipeline influence in one view.

Budget constraints and rising costs: AV, venues, and F&B have trended up while many teams face flat budgets. Counter with scenario planning, re‑scoped production (e.g., elegant minimalism over expensive builds), sponsor‑funded activations tied to measurable outcomes, and earlier contract negotiations. Codify “must‑have” vs. “nice‑to‑have” to protect ROI drivers under pressure.

Late registrations and demand volatility: Use tiered pricing, limited‑time bundles, and scarcity messaging tied to real inventory (seating zones, VIP lounges). Watch registration velocity and warm up waitlists. If demand surges, dynamically open capacity or add paid live‑stream passes to monetize overflow.

Time and resource limitations: Standardize templates (budgets, run‑of‑show, risk registers), operate stage gates to prevent late pivots, and build a bench of volunteers, ambassadors, and agency partners you can spin up quickly. Cross‑train staff on registration, customer care, and sponsor ops so you can flex during peaks.

Risk and contingency planning: Build a living risk register with likelihood/impact, owners, and mitigations. Include safety, security, weather, travel disruptions, and technical failures. Run table‑top drills, align with venue and local protocols, and publish escalation trees so anyone can act quickly if needed.

Data fragmentation and unclear attribution: Decide early which system is the source of truth for each metric and build integrations or exports before launch. Label campaigns consistently, enforce UTM hygiene, and align lead routing and scoring rules with sales before the event to avoid post‑event delays.

B2B SaaS Growth Summit: The team set 5 SMART goals, including $2M in pipeline influence and NPS 60+. They targeted 300 strategic accounts, created an executive lounge with curated peer tables, and used session scans to score intent. Post‑event, they launched a 21‑day nurture sequence by persona and triggered sales SLAs. Result: 412 SQLs, $2.7M influenced, and a 63 NPS. The playbook became the model for regional roadshows.

City Music Weekender: Late demand threatened to exceed capacity. Using reserved seat maps and tiered pricing, organizers opened a limited balcony section at a premium and added a sponsored live stream for overflow. With QR‑based concessions and mobile check‑in, they kept queues short and captured purchase data to improve next year’s set‑list scheduling and vendor mix. Sponsorship renewals rose by 28% on the back of clear performance reporting.

Document 3–5 SMART goals (include at least one learning goal) and map them to business KPIs and owners.

Complete a one‑page situation analysis and convert top insights into testable hypotheses for your program and promotion.

Build a one‑page plan linking strategies to tactics, budget, and metrics. Insert stage gates and decision rights.

Operationalize with weekly stand‑ups, vendor SLAs, staffing rosters, and a tech‑enabled run‑of‑show that captures data by default.

Instrument measurement and integrate with CRM/MA. Launch a 14–30 day data‑to‑action loop with sales SLAs and nurture programs.

Strategic event management transforms events from isolated experiences into a repeatable, data-driven system for growth. It connects vision to execution—aligning goals, audiences, content, and measurement under one clear strategy. When teams plan with intent, execute with cross-functional precision, and measure with discipline, every event adds compounding value to brand, pipeline, and customer relationships.

In a climate of tighter budgets and higher accountability, the organizations that treat events as strategic assets—not line items—are the ones that continue to grow influence, revenue, and community momentum year after year. Strategic event management isn’t just how great events happen—it’s how great businesses scale.